Have you ever wondered if you can use your Health Savings Account (HSA) to pay for a massage? If you’re looking for ways to make your wellness routine more affordable, this question is important.

You might be surprised by what counts as an eligible expense. Knowing the answer can help you save money while taking care of your body. Keep reading to find out exactly how your HSA can work for you when it comes to massages—and what you need to know before you book your next appointment.

What Is An Hsa?

A Health Savings Account, or HSA, helps people save money for medical costs. It works with high-deductible health plans. You can put money into this account before taxes. This lowers your taxable income. The money grows tax-free. You can use it to pay for health expenses.

HSAs give control over your healthcare spending. You decide how and when to use the funds. The money stays with you, even if you change jobs. It is a useful tool for managing health costs.

Basic Features

An HSA allows tax-free savings for medical expenses. You can contribute money up to a yearly limit. The funds roll over year to year. You keep the money even if you leave your job. The account earns interest or investment returns tax-free. Withdrawals for qualified expenses are also tax-free.

You must have a high-deductible health plan to open an HSA. The account is yours to manage. You can use it now or save it for the future. Some HSAs offer debit cards for easy spending.

Eligible Expenses

HSAs cover many medical costs. This includes doctor visits, prescriptions, and medical equipment. You can also pay for dental and vision care. Some over-the-counter items qualify too.

Massage therapy may be eligible if prescribed by a doctor for medical reasons. You need a written recommendation for massage as treatment. General relaxation massages usually do not qualify. Always check what your HSA provider accepts.

Massage Therapy And Hsa Rules

Understanding the rules for using Health Savings Accounts (HSA) on massage therapy is important. Not all massage services qualify for HSA payments. Knowing which massages count can help you save money and avoid surprises.

HSAs pay for medical expenses approved by the IRS. Massage therapy is sometimes allowed if it treats a specific health condition. The key is that the massage must have a clear medical purpose.

When Massage Is Covered

Massage therapy qualifies if a doctor prescribes it for a medical issue. Examples include treatment for injury, chronic pain, or muscle problems. You must keep a doctor’s note or prescription to prove it.

The massage must help treat or improve the health condition. Relaxation massages without medical reasons usually do not qualify. The therapist should be licensed or certified for medical massage therapy.

Keep receipts and any medical records. These documents support your HSA claims in case of an audit.

Common Exclusions

Massages for general relaxation or stress relief are often excluded. Spa massages, beauty treatments, and massages without medical reasons do not qualify. HSAs do not cover massages given by unlicensed practitioners.

Self-care massages or massages bought as gifts also do not count. Expenses must directly relate to treating a medical condition.

Always review your HSA plan rules. Some plans may have stricter limits on massage therapy coverage.

Medical Necessity Criteria

Medical necessity criteria play a key role in deciding if massage therapy can be paid for with an HSA. Insurance plans and HSAs often require proof that the treatment is essential for health reasons. This proof ensures that the massage is not just for relaxation but for a specific medical condition. Understanding these criteria can help you prepare the right documents and avoid claim denials.

Doctor’s Prescription

A doctor’s prescription is often required to show medical necessity. The doctor must state that massage therapy is needed for your health condition. This prescription should describe the illness or injury that massage can help. It acts as official proof that the treatment is part of your medical care. Without this prescription, your HSA might not cover the cost.

Documentation Requirements

Proper documentation supports your claim for HSA payment. Keep records of the doctor’s prescription and treatment plan. The therapist should provide notes on the sessions and progress made. These documents prove the massage is for medical reasons. Submit all paperwork with your HSA claim to increase approval chances.

How To Use Hsa For Massage

Using your Health Savings Account (HSA) for massage therapy can help manage costs. Understanding how to use your HSA correctly is important. This section explains the steps for paying with your HSA.

Filing Claims

Some massage providers do not accept HSA cards directly. You may need to pay out of pocket first. Then, submit a claim to your HSA administrator. Keep your receipt with details about the massage service. Include the date, provider’s name, and amount paid. Submit this information through your HSA’s online portal or by mail. The HSA will review and approve eligible expenses. After approval, you get reimbursed from your HSA funds.

Payment Methods

Many HSAs offer a debit card for easy payments. You can use this card to pay massage therapists who accept HSA cards. If the provider does not accept cards, pay cash or credit card first. Then file a claim for reimbursement later. Always check with your HSA plan about payment options. This helps avoid confusion and delays in payment.

Alternatives To Hsa For Massage Payments

Not everyone can use an HSA to pay for massage services. Thankfully, other options exist. These alternatives can help cover massage therapy costs in different ways. Understanding them can make paying easier and more flexible.

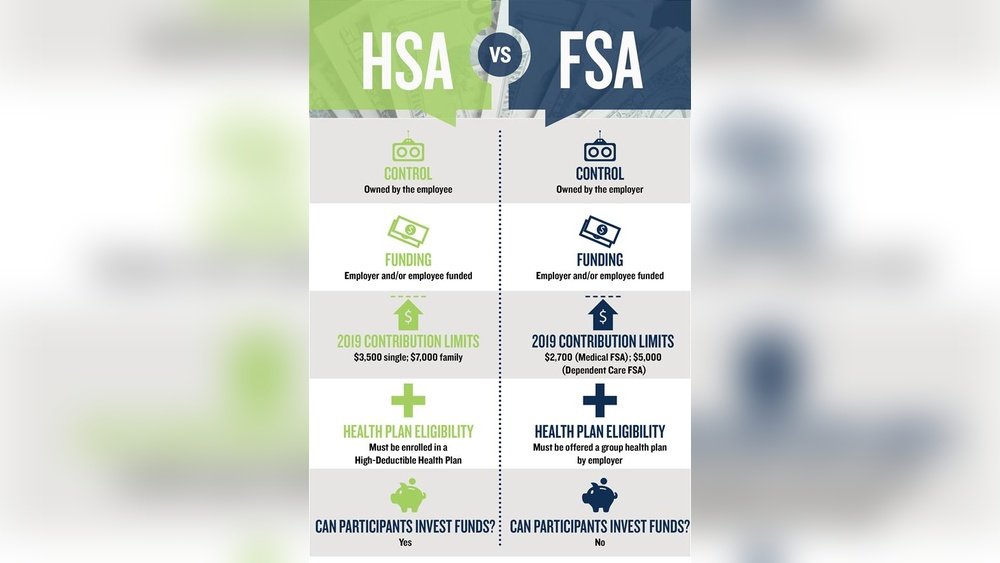

Fsa And Hra Options

Flexible Spending Accounts (FSA) and Health Reimbursement Arrangements (HRA) sometimes cover massage therapy. These accounts work like HSAs but have different rules. FSAs use money set aside before tax for health expenses. HRAs are employer-funded and reimburse certain medical costs.

Both FSAs and HRAs may allow massage payments if prescribed by a doctor. Verification is often needed to confirm medical necessity. This means a doctor must write a note explaining why massage is needed for treatment.

Other Payment Methods

Paying out of pocket is the simplest way to cover massage costs. Many people choose this without using special accounts. Some massage clinics offer payment plans or discounts for regular clients.

Credit cards and debit cards are common payment tools for massage services. Using these gives flexibility in managing your budget. Some insurance plans may also offer partial reimbursements, so check your policy details.

Tips To Maximize Hsa Benefits

Maximizing your Health Savings Account (HSA) benefits can save money on massage therapy and other health expenses. Proper planning helps you use your funds wisely. Following some simple tips ensures you get the most from your HSA.

Record Keeping

Keep all receipts for massages paid with your HSA card. Save invoices and payment proofs. These documents help prove the expense is eligible. Organize your records by date and provider. This makes it easy to access them if needed for tax purposes or audits.

Consulting Healthcare Providers

Talk to your doctor before using HSA funds for massage therapy. Some massages require a doctor’s note to qualify as a medical expense. Your healthcare provider can advise if your condition meets this requirement. Getting approval in writing supports your HSA claims and avoids issues later.

Frequently Asked Questions

Can I Use Hsa Funds For Massage Therapy?

Yes, you can use HSA funds for massage therapy if it is prescribed by a healthcare professional for a medical condition. Documentation from your doctor is required to qualify the expense as a medical necessity.

Are All Massages Eligible For Hsa Payments?

No, only massages prescribed to treat a specific medical condition qualify for HSA payments. General relaxation or spa massages are not eligible expenses under HSA rules.

What Documentation Is Needed For Hsa Massage Payment?

You need a doctor’s note or prescription stating massage therapy is medically necessary. This documentation supports the HSA expense if you are audited by the IRS.

Can I Pay For Massage With Hsa Debit Card Directly?

Yes, if your massage is medically necessary and documented, you can use your HSA debit card for direct payment. Keep all receipts and prescriptions for your records.

Conclusion

Massage payments with HSA depend on specific rules. Usually, massages for medical reasons qualify. Talk to your doctor about the need for massage therapy. Keep receipts and documents to prove the expense. Check your HSA plan details carefully before using funds.

Using HSA for massages can save money if rules allow. Always stay informed to avoid unexpected costs. This helps you make smart choices about your health spending.