Have you ever wondered if your Flexible Spending Account (FSA) can cover the cost of a massage? If you’re dealing with muscle pain, stress, or just need some relief, this question matters to you.

Using your FSA wisely can save you money, but not every expense qualifies. You’ll discover exactly when and how you can use your FSA for massage therapy. Keep reading to unlock tips that could help you get the care you need without breaking the bank.

Fsa Basics

Understanding the basics of a Flexible Spending Account (FSA) helps you decide how to use it. Knowing what an FSA is and how it works can save you money on healthcare costs. Many wonder if massage therapy qualifies for FSA expenses. Let’s explore the key points about FSAs to clear up the confusion.

What Is An Fsa?

An FSA is a special savings account for medical costs. It is offered by employers to employees. You put money into the account before taxes. This lowers your taxable income. You can use the money to pay for health-related expenses. FSAs are a good way to manage healthcare spending.

How Fsas Work

You decide how much money to put in your FSA each year. The money is taken from your paycheck in small amounts. You use the funds to pay for approved healthcare costs. You must use the money within the plan year. If you do not, you might lose the leftover funds. Some plans allow a short grace period or small carryover.

Eligible Expenses

FSAs cover many health-related items and services. These include doctor visits, prescriptions, and medical supplies. Some dental and vision care costs qualify too. Massage therapy may qualify only if prescribed by a doctor. It must treat a specific medical condition. Otherwise, general massage costs usually do not qualify. Always check your plan’s rules before using FSA for massage.

Massage Therapy And Fsa

Massage therapy offers many health benefits. It can reduce pain, ease stress, and improve blood flow. Some people wonder if they can pay for massage using their Flexible Spending Account (FSA). Understanding the rules about FSA and massage therapy helps you know when it is allowed and when it is not.

When Massage Is Covered

FSA funds can pay for massage therapy only if a doctor says it is medically needed. This means the massage must treat a specific health problem. Relaxation massages usually do not qualify. The massage should be part of a treatment plan for an illness or injury.

Medical Necessity Criteria

To use FSA for massage, the therapy must meet medical necessity criteria. A healthcare provider must diagnose a condition that massage can help. Examples include muscle pain, injury recovery, or certain chronic illnesses. The massage should improve or prevent worsening of the condition.

Documentation Requirements

Proper documents are needed to use FSA for massage therapy. A doctor’s note or prescription must explain the medical need. Receipts from the massage provider should show the type of service and date. Keep all papers in case the FSA administrator asks for proof.

Types Of Massages Covered

Flexible Spending Accounts (FSAs) sometimes cover massage therapy. But not all massages qualify. Understanding the types of massages covered helps you use your FSA wisely. Some massages focus on healing, others on relaxation or alternative approaches.

Therapeutic Massages

Therapeutic massages target specific medical issues. These massages can treat muscle pain, injuries, or chronic conditions. A doctor’s note often is required to use FSA funds for these. Examples include deep tissue and sports massages.

Relaxation Massages

Relaxation massages help reduce stress and tension. They feel good but usually do not qualify for FSA coverage. Swedish massage is a common type of relaxation massage. These massages focus on comfort, not medical treatment.

Alternative Therapies

Alternative therapies include massage techniques outside traditional methods. Examples are reflexology and shiatsu. Some may qualify for FSA if prescribed by a healthcare provider. Proof of medical need is important for coverage.

Claim Process For Massage Expenses

Claiming massage expenses through your FSA requires a clear understanding of the process. Knowing how to submit claims and what documents to provide helps avoid delays. This section explains the key steps to follow for a smooth experience.

Submitting Claims

Start by checking if your massage qualifies for FSA reimbursement. Submit your claim through your FSA provider’s website or app. Fill out the claim form with correct details about the service. Upload or attach the receipt showing the date and cost of the massage.

Required Receipts And Forms

Keep the original receipt from your massage therapist. The receipt must include the provider’s name, date, and service description. Some FSAs require a doctor’s note stating the medical need for massage. Include any required forms from your FSA plan along with the receipt.

Common Claim Issues

Claims often get delayed due to missing information or unclear receipts. Avoid vague descriptions like “therapy” without mentioning massage. Ensure receipts show the full provider details and exact dates. Double-check if your plan needs extra forms or doctor approval. Address these issues early to speed up your claim.

Tips To Maximize Fsa Benefits

Using your Flexible Spending Account (FSA) wisely can save you money on health expenses. Massage therapy may qualify for FSA payments if prescribed by a doctor. To get the most from your FSA, follow these simple tips. They help you avoid confusion and keep your benefits safe.

Choosing Providers

Select massage therapists who accept FSA payments. Confirm they provide a doctor’s prescription if needed. Check if the provider gives receipts with detailed information. This helps your claim process go smoothly. Avoid providers who do not follow these rules.

Keeping Proper Records

Keep all receipts and prescriptions related to your massage therapy. Store them in a safe place for easy access. These documents prove your expenses qualify for FSA use. Organize records by date and type of service. This habit helps during tax season or audits.

Planning Expenses

Estimate your yearly health needs before using your FSA. Set aside enough funds for massage therapy and other treatments. Use your FSA balance before the plan year ends to avoid losing money. Plan regular massages if prescribed, so you use your benefits fully. Timing your visits can help you manage your budget better.

Alternatives To Fsa For Massage Coverage

Alternatives to FSA for massage coverage offer different ways to pay for massage therapy. These options might suit your needs better. Understanding each one helps you choose the right plan.

Some alternatives provide more flexibility or wider coverage than FSAs. Others work well with your health goals and budget. Explore these options to find the best fit.

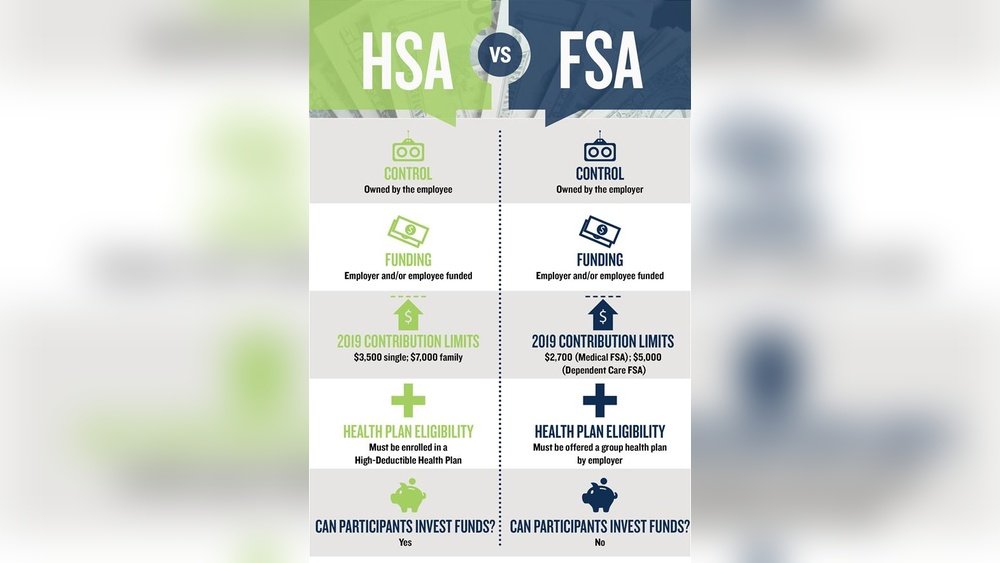

Health Savings Accounts (hsa)

HSAs allow you to save money tax-free for medical expenses. These include massages if prescribed by a doctor. You can keep unused funds year to year, unlike FSAs.

HSAs work with high-deductible health plans. They offer more control over your healthcare spending. Using an HSA for massage therapy may be easier for some people.

Flexible Spending Accounts (fsa) Vs. Hsas

FSAs and HSAs both save money for health costs. FSAs have a “use it or lose it” rule yearly. HSAs let you roll over funds without losing them.

FSAs do not require a high-deductible health plan. HSAs do. FSAs might cover massage therapy with a doctor’s note. HSAs generally offer more long-term savings benefits.

Other Insurance Options

Some health insurance plans include massage therapy coverage. Check your policy details for specific rules and limits. Coverage often requires a medical referral or diagnosis.

Wellness programs or employer benefits might also pay for massage. Some discount plans offer reduced rates on massage services. Explore these programs to reduce out-of-pocket costs.

Frequently Asked Questions

Can Fsa Cover Massage Therapy Expenses?

FSA funds can cover massage therapy if prescribed by a doctor. It must treat a specific medical condition. Without a prescription, massage expenses usually aren’t eligible for FSA reimbursement.

What Documentation Is Needed For Massage Fsa Claims?

You need a doctor’s prescription and a detailed receipt. The receipt should state the service date, provider, and amount. This documentation ensures your massage therapy expense qualifies for FSA reimbursement.

Are All Types Of Massages Eligible For Fsa?

No, only therapeutic massages prescribed for medical treatment qualify. Relaxation or spa massages typically don’t qualify. Check with your FSA plan to confirm eligible massage types.

How To Submit Massage Expenses For Fsa Reimbursement?

Submit your doctor’s prescription and itemized receipt to your FSA administrator. Use your FSA portal or mail the documents. Follow your plan’s instructions to ensure approval and reimbursement.

Conclusion

Using FSA funds for massage depends on your plan rules. Many FSAs cover massages if prescribed by a doctor. Keep a note or letter from your healthcare provider. This helps prove the massage is for medical care. Always check your FSA plan details before spending.

Doing so avoids surprises or denied claims. Massage can ease pain and help healing. It may qualify as a medical expense under FSA. Talk to your plan administrator for clear answers. Save receipts and documents for your records. This way, you use your FSA money wisely and legally.